You can include a cards or debit cards out of over 200 banking companies and you can borrowing unions you to help Fitbit Pay. And then Fitbit Shell out can be utilized anywhere you see the newest touchless percentage image. With Pursue for Organization you’ll found guidance of a team of business experts who specialise in assisting raise cash flow, delivering credit choices, and managing payroll.

- You still rating all credit’s advantages and you will benefits — which means you claimed’t lose out on people tough-earned items or kilometers.

- You might shell out along with your phone in locations everywhere the thing is that the newest contactless icon.

- Earn 2% cash back to your very first $25,000 invested inside the combined orders from the gasoline stations and food for each and every account anniversary year (following step 1%) and step 1% on the any other requests.

- When you yourself have several notes, you happen to be motivated to pick if you want to include so it credit since your standard cards.

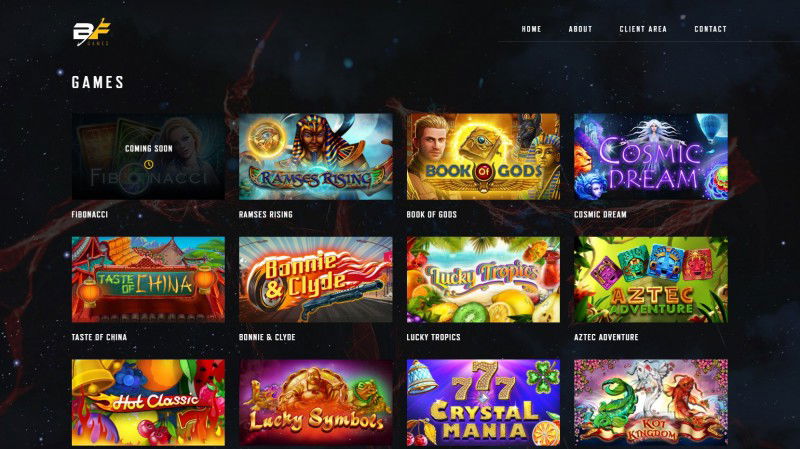

Deposit 5$ get 80 casino – Google Pay

You could shop numerous cards on your mobile phone at a time, so you could like additional notes for different sales. Just touching the brand new credit you should fool around with immediately after twice-clicking – you can find them bunched right up in the bottom of your own display screen. Just like Fitbit Spend, specific Garmin view profiles can use Garmin Pay making orders playing with just their watch.

Ink Team Bucks Bank card

We feel people should be able to make financial conclusion with confidence. You might notably help the redemption rate by-turning your cash back into Biggest Benefits issues from the pairing so it card that have a card for instance the Chase Sapphire Put aside. Because the Ink Company Common Charge card now offers bonus items to your office-relevant investing, it’s an excellent matches for small-business owners. Consider your iphone 3gs if you’ve create Deal with ID to confirm their name, or go into your own PIN otherwise code.

In the Apple

Android KitKat is a fair number of years dated today and if you are not running you to definitely software it could be worth deposit 5$ get 80 casino checking so you can see if there’s an update. Lender deposit accounts, including examining and you may savings, could be susceptible to approval. Deposit products and related services are provided by JPMorgan Chase Financial, N.A. Affiliate FDIC. Basic, to your electronic handbag getting obtainable merely on your own electronic gadgets, in case your battery passes away when you are out shopping or if you misplace your own unit, your get rid of the ability to shell out with those gadgets. When using an app, including you to for buying eating otherwise a trip-share provider, you can choose make use of your Electronic Handbag while the fee choice.

- For those who have numerous cards, faucet Build standard lower than them to set the one that will be first-in the fresh queue and in case you’re investing to have something.

- It’s smoother, along with you can earn beneficial things if you pay which have a benefits card.

- Apple Spend works anywhere that takes contactless money — away from vending servers and you will super markets to help you taxis and you will train stations.

- Transportation possibilities within the four You.S. cities support Fruit Spend, since the create transportation workers within the Canada, the united kingdom, and Asia, certainly various countries.

They’lso are located on the payment critical monitor otherwise cash register at the checkout. All about three of these programs will then request you to include your own cards facts by firmly taking a photo of one’s card in itself plus bank will send a confirmation code since the a book content otherwise via name. Apple Pay can be utilized during the food markets, dinner, gas stations and retail stores as well as for everything from vending servers to trains and you can taxis. Just find the overall contactless percentage icon and/or certain Apple Spend icon to understand if you’re able to have fun with Apple Pay from the a particular percentage terminal.

Rates isn’t the only real benefit of playing with a digital wallet to invest to possess one thing along with your mobile phone. Digital purses in addition to protect your own personal information by using a great procedure called tokenization, which encrypts their card’s information which means that your real cards number isn’t shared with merchants. Of a lot be aware of the feeling of reputation from the a good checkout line, fumbling as a result of a wallet to find the right charge card otherwise relying in the dollars you’ll need for a buy. To invest that have Apple Pay to the an apple View, double-tap the medial side option plus standard cards will appear—contain the observe near the contactless reader unless you getting a great hype on your own arm. If you would like have fun with a different cards apart from your standard one to, swipe left or close to the brand new cards itself.

Listed here are seven notes that will make it easier to maximize your portable invoice. You simply will not rating “items rich” by simply spending the monthly smartphone statement with credit cards. But it’s however crucial that you utilize the right cards to fund one monthly expenses. Particular issuers also provide smartphone-associated rewards, such dependent-in the mobile phone security, to own once you damage your own cell phone. If you’lso are playing with a good WearOS check out, you’ll need to set up the new Yahoo Spend application on your own cellular telephone, up coming make use of the observe interface to choose among the notes you’ve create. There are some strong alternatives if you are looking for the best cellular commission apps, while the saw by the possibilities i’ve in this guide.

You can even go to the individual internet sites to learn more about the research and confidentiality strategies and you can opt-away alternatives. For individuals who’re looking in the merchandising cities, you can keep their cellular telephone otherwise unit more a point-of-product sales program no matter where the thing is the newest Contactless Icon. While shopping on the smartphone, there’s usually a single- or a couple- simply click payment fast to make it as simple as possible. Keep reading to have methods to certain faqs on the scraping and paying together with your cell phone. As the direct procedures can vary a bit depending on whether you have fun with an apple’s ios otherwise Android unit, the entire setup will be apparently comparable round the some portable names.

Earn 2% money back to the basic $twenty-five,one hundred thousand spent inside mutual orders in the filling stations and you can dinner for each membership wedding season (next 1%) and step 1% to your any other requests. Since 2024, the average expenses to possess a mobile package stands during the $144 a month otherwise $step 1,728 a-year, according to CNBC. TPG thinking Biggest Benefits items during the a hefty 2.05 cents apiece, definition in the step three things per buck, you will get from the $106 within the really worth a-year by just spending their mobile phone costs which have which credit. At the TPG, we’re all on the helping clients find a method to optimize the purchase you can, from the everyday latte go to your own monthly cell phone statement.